cdfiCORP would like to create a world where all people, from all communities, have all-access to the loans, credit and liquidity that’s needed to live and thrive.

cdfiCORP is the plug that connects education & opportunity; cdfiCORP aspires to secure CDFI certification to unite public and private resources, stimulate job creation, foster business growth, and combat foreclosures while leveraging local capital.

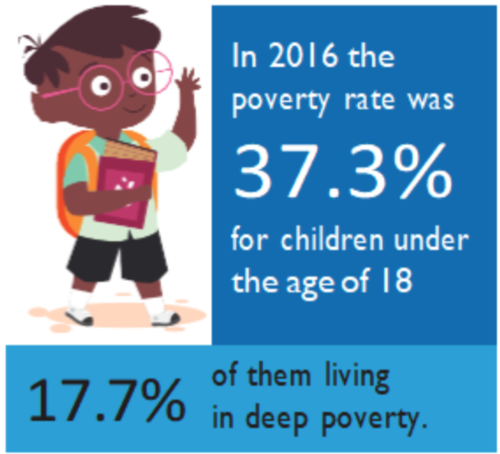

Our educational initiative, BanksGiving, is dedicated to eradicating blight and empowering low-income Black communities in Philadelphia by disseminating essential knowledge to every household. We firmly believe that by equipping individuals with both financial resources and education, we can level the playing field for minorities, enabling them to attain financial security and freedom.